Embedding financial literacy into the heart of cities

The Financial Freedom Project provides K-12 students with interactive learning experiences on critical financial concepts. Families, educators, communities, and school faculty and staff also benefit from the Financial Freedom Project’s wrap-around services.

In-Classroom Lessons

IMC staff & volunteers from local financial institutions (see our partners) will lead in-class lessons.

5,000 Bank and Investment Accounts

Thanks to our partner, Goalsetter, students & faculty/staff will get access to bank and investment accounts.

$250,000 of Donated Stock

The Goalsetter Foundation will donate stock to students provided by its partner companies such as Nike, Delta, Twitter, Lyft, HP, Comcast, + more.

Financial Empowerment Fairs

The financial empowerment fair is a one-day event that will educate participants on financial wellness basics and provide direct access to organizations and programs that could provide immediate financial relief, stability, and guidance.

Goalsetter App Access

Students will get access to the Goalsetter app, which includes hundreds of hours of video mapped to national financial standards.

Monthly Financial Workshops

Workshops will include presentations, Q&As, and an introduction from Black-Ish television star Anthony Anderson!

One-on-one Financial Consultations

Faculty and staff can speak to financial professionals to help them manage financial issues, identify immediate action steps, and make referrals to other services at no cost.

Most initiatives focus on the students and unintentionally overlook the faculty/staff and parents/caretakers.

Most initiatives focus on the students and unintentionally overlook the faculty/staff and parents/caretakers.

“We can only give students the foundation they need for future financial success if educators and staff feel more secure in their own financial beliefs, knowledge, habits and goals. And we must be equally vigilant about providing the adults in their households with the same level of support.”

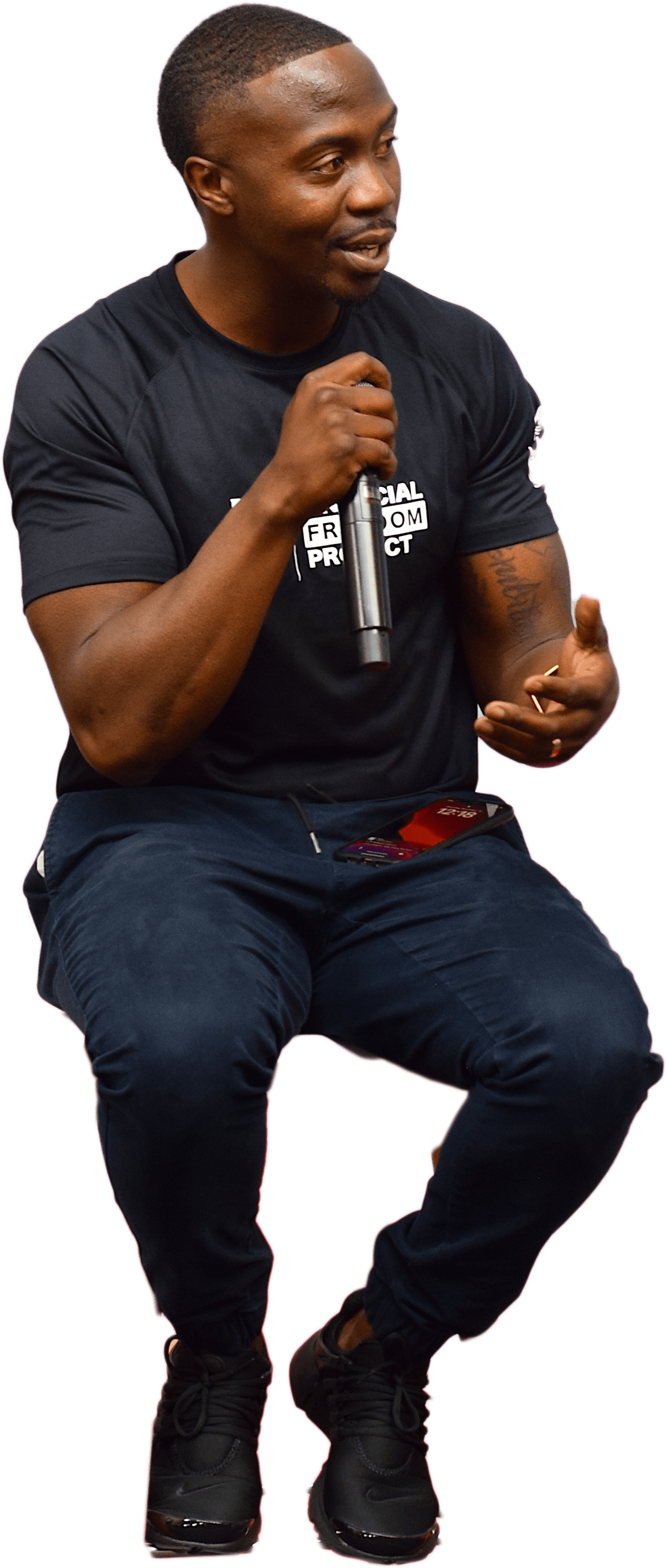

Isaac M. Cooper

FFP Founder/IMC Financial Consulting CEO

Free 1-on-1 financial

consulting for parents & staff

Faculty/staff and the parents/caregivers of students at our 6 pilot schools can now schedule one-on-one consultations with financial experts. We are providing professional guidance to help manage financial issues, identify immediate action steps, and make referrals to other services at no cost.

Consultations will be facilitated by the staff of IMC Financial Consulting and local financial experts.

Birmingham Mayor

Randall Woodfin on the Financial Freedom Project…

“The time is now to ensure that our youth are the most financially prepared and successful generation our country has produced. We have both a professional and moral responsibility to ensure the academic and financial success of our students. Their participation in our local, national and global economy is critical to the future of our community and our country, and it is our responsibility to cement their financial foundation as a cornerstone of their financial well-being.”

“The time is now to ensure that our youth are the most financially prepared and successful generation our country has produced. We have both a professional and moral responsibility to ensure the academic and financial success of our students. Their participation in our local, national and global economy is critical to the future of our community and our country, and it is our responsibility to cement their financial foundation as a cornerstone of their financial well-being.”

View our

2023 Annual Report!

Get in Touch.

If you have a question about the Financial Freedom Project or need to get in touch with FFP staff, please complete the form below. One of our team members will be in touch with you shortly!